Akhuwat Loan Scheme 2024 Online Apply

Akhuwat Loan Scheme 2024 Online Apply @akhuwat.org.pk, Akhwat Foundation introduced Mera Pakistan Mer Ghar programme, which offers non-profit home construction loans through online registration. The government launched this program to enable all Pakistanis to build their houses by 2024, using the Akhwat Loan Scheme 2024. This article provides complete information about the Akhwat Foundation Loan Scheme, describing its purpose and historical background. Akhuwat’s main objective is to fight poverty in Pakistan and to achieve this, they have worked hard to provide Akhuwat 2024 Loan Program to low-income people.

Akhuwat Loan Scheme 2024 Application Form Download

Akhuwat is a non-governmental organization (NGO) based in Pakistan that is well-known for its interest-free microfinance and loan programs. The Akhuwat Loan Scheme is one of their flagship programs, designed to provide financial assistance to low-income individuals and small entrepreneurs to help them start or expand their businesses and improve their living conditions. Here are key details about the Akhuwat Loan Scheme:

- Interest-Free Loans: The most distinctive feature of the Akhuwat Loan Scheme is that it provides interest-free loans. The organization does not charge interest on the loans it disburses, in line with the principles of Islamic finance.

- Microfinance: The scheme focuses on providing microfinance loans, which are relatively small loans that are accessible to low-income individuals, including those who may not have access to traditional banking services.

- Eligibility: Akhuwat’s loan programs typically target the marginalized and underprivileged segments of society. Eligibility criteria may vary depending on the specific loan product, but they often prioritize those in need.

- Loan Types: Akhuwat offers various types of loans to cater to different needs, including business loans, education loans, emergency loans, and housing loans.

- Loan Size: The loan amounts are generally small, tailored to the specific requirements of borrowers. The organization aims to provide a helping hand to those who might otherwise not have access to credit.

- Repayment: Borrowers are expected to repay the loan over a defined period. The loan repayment terms are generally flexible, and Akhuwat works with borrowers to ensure that the repayment is manageable.

- Impact: The Akhuwat Loan Scheme has had a significant impact on poverty alleviation and economic empowerment in Pakistan. It has helped numerous individuals and families improve their socio-economic conditions.

- Community-Based Model: Akhuwat operates using a community-based model, often involving local volunteers and organizations to facilitate the loan disbursement and repayment process.

- Non-Profit Organization: Akhuwat is a non-profit organization, and the funds it collects are primarily used to support its mission of providing interest-free loans and other social welfare initiatives.

- Expansion: Over the years, Akhuwat has expanded its operations and introduced various initiatives to support education, health, and economic development in addition to microfinance.

If you are interested in applying for an Akhuwat Loan or want to learn more about their programs and eligibility criteria, I recommend visiting the official Akhuwat website or contacting them directly for the most up-to-date information on the available loan schemes and application procedures.

Akhuwat Loan Scheme 2024 Online

All Pakistanis should build their home, using a loan from the Akhuwat Foundation. The principal goal is to aid those who are less fortunate in the Muslim community. I will explain the process more in detail in this article. As a consequence, the Akhuwat Loan Scheme 2024 was created by the community’s entrepreneurs to assist them in expanding the size of their enterprises. Akhuwat loans scheme for online Application for ” Mera Pakistan mere Ghar program” get a non-profit loan or online registration and verification process.

Akhuwat Loan Registration Online Last Date

To register for an Akhuwat loan, you will typically need to follow a specific application process. Please note that the exact registration process and requirements may vary, so it’s important to consult Akhuwat’s official website or contact them directly for the most up-to-date information and guidance. Here are general steps you can follow to register for an Akhuwat loan:

- Visit the Official Akhuwat Website: Start by visiting Akhuwat’s official website to find information about their loan programs, including the eligibility criteria and application process. The website may have a dedicated section for loan applications.

- Review Eligibility Criteria: Carefully review the eligibility criteria to determine whether you meet the requirements for an Akhuwat loan. Eligibility criteria may include factors such as income, business type, and location.

- Gather Required Documents: Collect the necessary documents and information that Akhuwat may require for the loan application. These documents may include your identification, proof of residence, business documents (if applicable), and other relevant information.

- Contact Akhuwat: Reach out to Akhuwat through the contact details provided on their website. You may find phone numbers, email addresses, or local office addresses for inquiries.

- Request an Application Form: Ask Akhuwat for an application form, either by downloading it from their website or requesting it from one of their local offices. Some application forms may also be available online for electronic submission.

- Complete the Application Form: Fill out the application form accurately and provide all required information. Be sure to attach the necessary documents as specified in the application guidelines.

- Submit the Application: Submit your completed application form and supporting documents to Akhuwat. This may involve mailing the documents to a specific address or delivering them to a local Akhuwat office.

- Follow Up: After submitting your application, it’s a good practice to follow up with Akhuwat to ensure that your application is received and processed. You can inquire about the status of your application and any additional steps that may be required.

- Attend an Interview or Meeting (if required): Depending on the loan program and your application, you may be asked to attend an interview or meeting with Akhuwat representatives to discuss your loan proposal.

- Loan Approval and Disbursement: If your application is approved, Akhuwat will inform you of the loan approval and disbursement process. Ensure that you understand the loan terms and conditions before accepting the loan.

It’s important to note that Akhuwat has specific loan programs tailored to various needs, including business loans, education loans, housing loans, and more. Therefore, the specific application requirements and steps may vary based on the type of loan you are seeking.

Akhuwat Loan Scheme 2024 Online Apply Pakistan

It was initially an insignificant organization beginning in the year 2001, this organization swiftly became the biggest in the world, offering the entire country of Pakistan no-interest emergency loans. The government announced its Mera Pakistan mere Ghar program 2024 or the PM Home loan scheme in 2024. It’s becoming more and more common for people to avail of these loans in order to set up their own companies and achieve their goals during challenging times.

Akhuwat Loan Verification Process

To verify details or information related to Akhuwat’s loan programs, including your application status, loan eligibility, and other specific queries, you should contact Akhuwat directly. They have an established system for inquiries, verification, and assistance. Here are the steps to verify your Akhuwat loan program details:

- Contact Akhuwat Customer Support:

- Visit the official Akhuwat website to find contact information, which typically includes phone numbers, email addresses, and office addresses.

- Reach out to the Akhuwat customer support or contact center through the provided contact details.

- Inquire About Verification:

- Clearly communicate your verification needs to the Akhuwat customer support. Provide them with the necessary details, such as your application reference number or other relevant information.

- Provide Necessary Information:

- Be prepared to provide personal information or application details that will help Akhuwat identify and verify your application or loan status.

- Follow Their Instructions:

- Akhuwat’s customer support will guide you on the verification process and provide information based on your specific query. They will let you know what documents or details are required for verification.

- Visit Local Akhuwat Office:

- If necessary, you can visit a local Akhuwat office or branch in your area to inquire about your application or loan status. They can often provide assistance in person.

- Keep Records: It’s a good practice to keep records of your communication with Akhuwat, including the names of the representatives you speak to and any reference numbers provided during your conversation.

Remember that Akhuwat is committed to assisting individuals and communities through its loan programs and other initiatives. Their customer support team should be able to help you with your verification needs and answer any questions you have regarding your loan application or loan status.

www.akhuwat.org.pk application form 2024

Akhuwat Loan Scheme Process 2024 Complete the procedure on how to apply Download Akhuwat Loan Application Form at akhuwat.org.pk. Initially a modest organization that started in 2001, the organization quickly expanded to become the largest in the world, providing the entire country of Pakistan with interest-free emergency loans.

Akhuwat Loan Scheme Online Apply

To apply for the Akhuwat Loan Scheme, the applicant needs to visit the nearest Akhuwat branch and fill out an application form. Akhuwat Loan Scheme is a financial program in Pakistan that aims to provide interest-free loans to deserving and poor people. To apply online, visit the Akhuwat website or download their mobile app. Follow the instructions to create an account, complete the application form.

Akhuwat Loan Status Check Online

All Pakistanis are scheduled to build their houses by 2024 using the loan provided by the Akhwat Foundation through the Akhwat Loan Program 2024, with the help of banks across Pakistan. This has been a never-ending struggle to rid our society of poverty. This article will provide complete information on how to apply for Akhuwat Foundation Loan Program 2024 through the online application form.

Akhuwat Loan Online Apply

Muslim Sahabi’s personal belongings, as well as funds, were distributed to their families at the request of the Prophet Hazrat Muhammad. The word “Akhuwat” originates from the Arabic word “Mawakhat,” which means “brotherhood” (S.A.W). How much is available if you are planning to build a home that is 5 marlas? How much of a monthly installment will you need to make in addition to the length of time you are able to borrow in addition, what are the requirements to get the loan?

Akhuwat loan calculator

The aim of the Akhwat Loan Scheme 2024, established under section 42 of the Companies Act, 1984, is to help strengthen the country and enable it to stand on its feet. Watch the complete tutorial of Akhuwat Loan Scheme 2024 application form on this website and then share the information with your friends to ensure that if they decide to build their own house using Akhwat Loan Scheme 2024 application form, they will They will benefit from it.

Eligibility Requirements for Akhuwat Loans

- A guy must meet the following criteria to be eligible for a loan:

- Original CNICs must be provided by the applicant.

- To be eligible, the applicant must be between the ages of 18 and 35. (18 to 62 Years)

- To be eligible, the applicant must be involved in the local economy.

- Any criminal behavior that the applicant has engaged in will not be admissible.

- Candidates have a high social standing and a strong moral character.

- Even if the guarantee is a member of the applicant’s family, the applicant had to produce two guarantors.

- In order to be eligible, the applicant’s home must have stayed within a 2-2.5-kilometer radius of the branch’s office.

- The Akhuwat loan qualifying requirements might be amended at any moment.

Akhuwat Home Loan Scheme 2024 Registration Online

The loan application was reviewed by your unit manager, who also processed all necessary additional details and verified the supporting documents of the documents. Please be sure to send all documents required for approval of your loan application to your unit manager along with any additional information that may be requested.

www.akhuwat.org.pk Application Form 2024 Online

Who is eligible for the loan and what are the requirements. Except in the case of agriculture, where there is no form to fill out. The cost of the loan is 200 rupees. Dear Readers, There is a website available for you which provides information about Akhuwat Loan Scheme 2024 application form and I will send you the link of the website. I will give you the opportunity to see all these details for yourself in 2024.

Akhuwat Home Loan Apply Online

One must first complete an application for an interest-free loan through the Akhuwat Foundation, which can be found in Qard Hassan, then complete the application and send the completed form to the AIM branch near the man’s home. You created a program to build your own house, but it doesn’t help build the house. Pakistan announces seven things during National Day in country.

Akhuwat Loan Scheme Interest Rate

Akhuwat loan scheme in Pakistan is known for providing interest-free loans. This means that Akhuwat does not charge interest on the loans it disburses, in accordance with the principles of Islamic finance. The organization operates on the concept of Qard al-Hasan, which is a benevolent, interest-free loan.

However, please note that loan programs and their terms can change over time, so it’s important to verify the specific interest rate or loan terms for the Akhuwat loan scheme by checking the most recent information available on their official website or by directly contacting Akhuwat or visiting one of their local offices.

Keep in mind that the primary goal of Akhuwat’s loan scheme is to provide financial assistance to low-income individuals and entrepreneurs without the burden of interest, thereby promoting financial inclusion and social development.

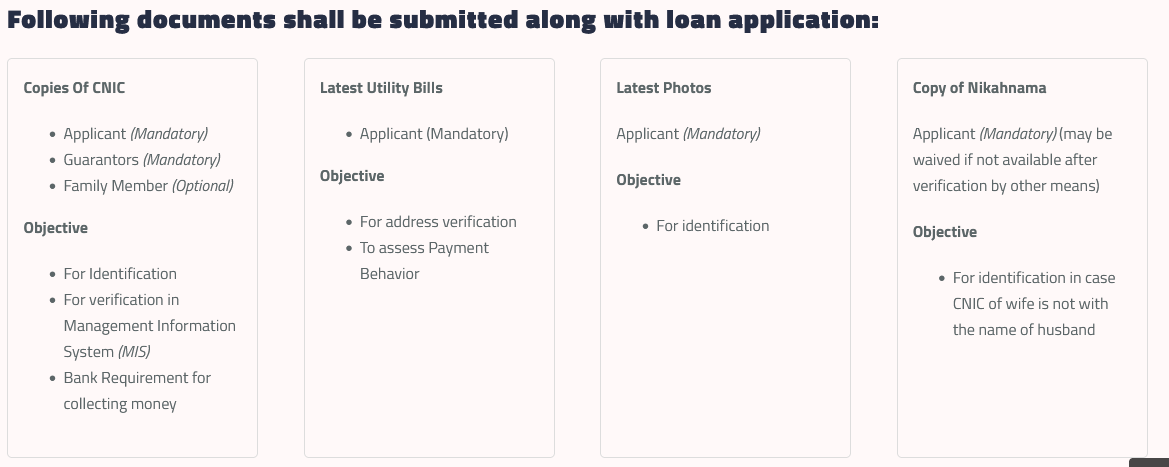

Documents Required for Akhuwat Loan Scheme Apply Verification

Akhuwat Loan Scheme 2024 Online Apply Form

The application form for the Qard Al Hassan loan program for the benefit of Akhuwat 2024 is usually the initial autumn loan that a person receives. Except for agriculture, in this case there is no application form and the application fee is $200. Fill out the required forms and send them to the AIM branch closest to where you live. The applicant must first fill out an application for interest-free loan from Akhuwat Loan Scheme 2024 located at Qard Hassan, then fill out the form and submit it to the AIM branch located near her residence.

Apply Online Akhuwat Loan Scheme

Akhuwat Loan Best Use in Pakistan

Akhuwat provides interest-free loans to support various financial needs of individuals, especially those from low-income backgrounds. The best use of an Akhuwat loan depends on your specific financial goals and needs. Here are some common and beneficial uses for Akhuwat loans:

- Small Business Start-up or Expansion: Many individuals use Akhuwat loans to start a small business or expand an existing one. This can lead to increased income and financial stability.

- Education Expenses: Akhuwat loans can be used to cover educational expenses, such as tuition fees, books, or vocational training courses. This can help improve your qualifications and future earning potential.

- Home Improvement: Loans can be used to make improvements to your home, which can enhance your living conditions and increase the value of your property.

- Emergency Medical Expenses: In the event of medical emergencies or health-related expenses, Akhuwat loans can provide the necessary funds to cover medical bills, surgeries, or treatments.

- Debt Consolidation: If you have high-interest debt from various sources, you can use an Akhuwat loan to consolidate and pay off those debts, leading to lower interest costs and improved financial management.

- Income-Generating Assets: You can invest in income-generating assets, such as livestock or machinery, which can increase your income and assets over time.

- Agriculture or Farming: Loans can be used for agricultural purposes, including purchasing seeds, fertilizers, or livestock, which can improve agricultural yields and income.

- Housing: Akhuwat loans can be used to finance the construction or purchase of a home, helping you secure housing for your family.

- Skills Development: Invest in skills development and training programs to enhance your employability and job prospects.

- Empowerment of Women: Akhuwat encourages the empowerment of women by providing loans for various purposes, including entrepreneurship and skill development.

When considering the best use of an Akhuwat loan, it’s important to assess your financial situation and goals. Create a budget and plan to ensure that you use the loan effectively and responsibly. Additionally, you should discuss your financial goals and loan purpose with Akhuwat to understand the terms and conditions associated with the loan.

Remember that responsible financial management is essential, and it’s a good practice to use loans for purposes that will have a positive impact on your financial well-being and help you achieve long-term financial stability.

Read More!

Bila Sood Qarza Scheme Apply Online

Kamyab Jawan Program Application Status Check Online

8171 Ehsaas Program 12000 Online Apply SMS

Ehsaas Kafalat Program 2024 CNIC Online Registration

FAQs

How to Apply for Akhuwat Loan Online?

You must be a Pakistani citizen to qualify to participate in this program. Akhuwat Foundation’s interest-free loan program. All applicants have to submit loan applications along with supporting documents electronically. There are several loan options to choose from, with an amount ranging from 50000 to 150000 rupees.

How much maximum loan can I get from Akhuwat?

Under the said scheme, poor and deserving families will be provided with financial assistance as per Shariah compliant product up to PKR 500,000/- through Akhuwat Islamic Microfinance (AIM). This scheme seeks to support the poor both economically and socially. Repayment period is from 13 to 60 months.

Can I apply online for an akhuwat loan?

It is an interest-free loan for sisters and is provided to people with limited income through the organization. There is a strong institution in Pakistan that offers interest-free loans and also a down payment to brothers for the construction of their house through Akhwat Loan Scheme 2024, which will be available within a week. You must be a citizen of Pakistan to be eligible to apply for the Akhuwat Foundation Interest-Free Loan Program. There are many loans available ranging from Rs 50,000 to Rs 150,000. Islamic charity and interest-free loan provider NGO in Pakistan- Akhuwat. Donate to channel your zakat & sadaqah transparently, to the needy.

Who is eligible for Akhuwat loan?

Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC. Having the ability to run / initiate business activity having age between 18-62 years. Applicant should be economically active.

How to Online Apply Akhuwat Loan Acheme 2024 Pakistan?

Provide homes building loans to those who are unable to afford enough money to construct their own home and have a poor income in order to obtain loans up to Rupiah. Based on your opinion, you can read the full text here. In 2024, all Pakistanis must get a loan from the Akhuwat Foundation to construct their own home. Shariah will be a dependable lender and it won’t make any commotion and the loan is a good deal. In this article, I’ll go into great detail about the things I’m going to discuss.

What is the repayment rate of Akhuwat?

99.9%, Exceptional trust that promises sustainable recovery rates, The trust and ownership of the program felt by poor communities is evident in Akhuwat’s 99.9% loan repayment rate.

akhuwat loan scheme contact number

- Address: 19 Civic Center, Sector A2, Township, Lahore, Pakistan

- Call: 042-111-448-464

- Email: [email protected]

- Website: www.akhuwat.org.pk

More Topics!

akhuwat loan scheme 2024 application form download

akhuwat loan apply

akhuwat loan scheme 2024 online apply

akhuwat loan calculator

akhuwat loan scheme online apply

Akhuwat loan scheme interest rate

akhuwat loan amount

akhuwat loan details

akhuwat loan scheme 2024 online apply

Akhuwat loan scheme online apply in urdu

akhuwat loan apply

akhuwat loan application form pdf

akhuwat loan details

akhuwat loan in urdu

akhuwat registration

akhuwat loan for business